Predicting Startup Returns: How VCs Use AI to Make Investment Decisions and Identify Successful…

Haley Samuelsen

Predicting Startup Returns: How VCs Use AI to Make Investment Decisions and Identify Successful Startups

Venture Capital (VC) dealflow and decision-making is notoriously risky and imprecise. 75% of venture backed companies fail to return any money to investors, while many present-day unicorns were ignored by VC firms until well into their growth. What’s more, 50% of VC firms generate less capital than they invested, and only 5% of firms generate the 3x or more returns needed to make this form of investing worthwhile.

In a world where big data and artificial intelligence (AI) have become important components of decision-making, many venture capital firms have decided to scale back on the antiquated use of traditional business pitches and opt for more reliance on data assessments and technology platforms to make investment decisions. Without the objective measures that these tools provide, human nature can lead to subjective, biased, and time-consuming investment approaches which can result in making the wrong investments.

Many of these AI technology platforms will gather data about the product and financial situation of a startup and use an algorithm to give a recommendation to the VC firm on whether or not to invest in it. However, some platforms are also placing heavy emphasis on the human element of a successful startup to create a more robust analysis of a potential investment. VC firms that choose to incorporate behavioral aspects into their screening technology realize the importance of identifying startup teams that have a strong drive to act on what they have created and overcome obstacles that arise. As technological advances continue, it is likely that VC firms will further harness the power of technology to help solve some of the persisting problems in the industry and more accurately measure the future success of startups.

Meet the AI Game Changer

One VC firm that has implemented data and technology as part of their investing strategy is Connetic Ventures, a VC firm that has developed and launched an AI platform named Wendal. Companies looking for funding from Connetic complete Wendal’s online assessment in less than 15 minutes, and the data gathered allows Connetic to make an extremely informed decision about the strength and viability of the potential deal. Over half of the algorithm is based on behavioral factors because Connetic believes that the personal characteristics of a startup team is a key indicator of their future success. Connetic says Wendal “automates the due diligence process for early-stage companies” and is “essentially 4–5 MBA educated analysts … [but] is self-learning and can recall over a billion data points on command.” Wendal’s exceptional attributes mainly aim to fix three common problems prevailing in the VC industry.

1. Instinctive Investing

We have all probably been there. Not having tried it before, we see food that looks or sounds good, and based solely on instinct, we decide to purchase it and give it a try. To our dismay, what we thought would be a delicious treat ends up giving us a repulsive taste in our mouth and maybe even a bad stomach ache. Similarly, many investment opportunities can sound exciting and enticing, and VC decision-makers may say that the deal “just feels right” to pursue. However, the investment may not be the right fit for a particular VC fund, may have lacking financials, or may not have ideal founders behind the scenes. Using AI allows VC firms like Connetic to get a true and clear picture of their potential investment without having to worry about unforeseeable factors that could turn an investment into a terrible stomach ache, especially when large amounts of money are on the line.

2. Investor Bias

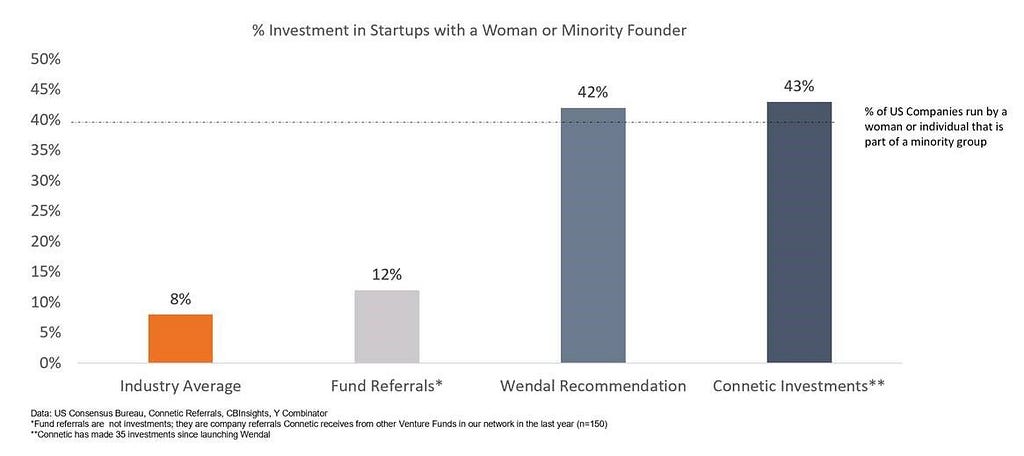

Bias is prevalent everywhere there is human involvement, and this can be a big concern when relying on traditional in-person pitches for VC funding. Bias in the humas designing AI algorithms is another concern about how these algorithms make decisions. Across the board, VC fund managers tend to be male, with only 11% of VC decision-makers being female. Female entrepreneurs can be asked very different questions during VC pitches, and in 2019, only 2.8% of VC capital went to businesses founded or co-founded by women. This is a significant contrast to the fact that women-owned businesses represent 42% of all businesses in the U.S. With Wendal, Connetic is committed to increasing the fairness of the VC funding process and helping remove gender bias. Connetic notes that “Wendal does not know your age, race, or gender when you apply for funding which gives everyone an equal opportunity.” It makes sense for VC firms to escalate their focus on the gender gap because it has been proven that women-led teams generate a 35% higher return on investment than all-male teams. With the implementation of Wendal, Connetic Ventures’ funding for women and minorities has reached a rate that is 8x higher than the industry average.

3. Excessive Time to Analyze Potential Investments

With time being one of the most valuable resources in today’s age, AI can be a win-win for both the VC firm and the pitching company. Using Wendal, Connetic does not have to waste time listening to irrelevant pitches, and on the flip side, businesses do not have to spend hours preparing perfected presentations. The Wendal application takes less than 15 minutes to complete and quickly gives results to Connetic to help them decide if the company would be a good investment for them. Through Wendal, Connetic is able to sift through numerous potential portfolio companies and choose optimal businesses from an expanded investment pool.

The Results

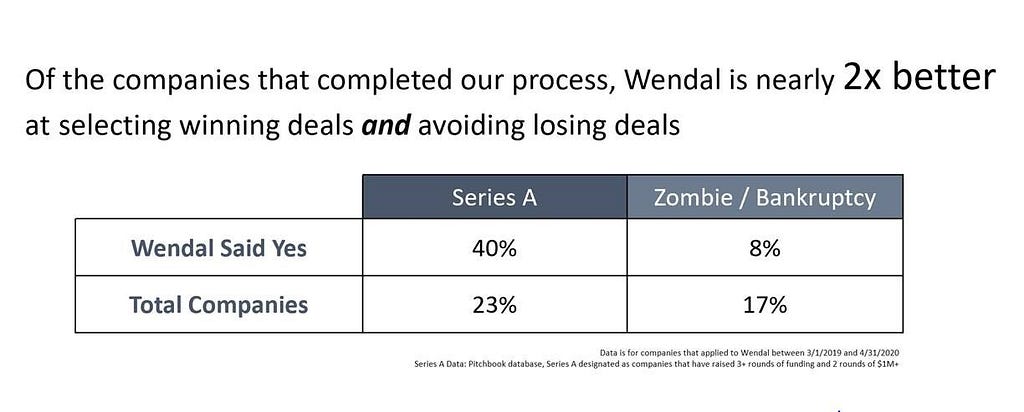

Along with all of the aforementioned benefits, Wendal has proven to be nearly two times better at selecting winners and avoiding losers. While not perfect, Wendal has helped Connetic get closer to achieving their overarching goal of utilizing data and technology to remove bias, create transparency, and increase the likelihood of success.

As technology becomes smarter, it is likely AI and other platforms will be must-haves in the private investment industry. Although success is never guaranteed, using unbiased and reliable technological tools have proven to increase the odds of realizing substantial returns for VC firms, all while promoting fairness in the process.

This article was written by Haley Samuelsen, an Associate Consultant with Strategica Partners.

Predicting Startup Returns: How VCs Use AI to Make Investment Decisions and Identify Successful… was originally published in Strategica Partners on Medium, where people are continuing the conversation by highlighting and responding to this story.