This article was originally published by Strategica Partners on Forbes.

Your business is preparing to launch a brand new product into the market. The product has been built and refined through many iterations, and now you are ready to ship it to customers. Only one question remains: what price should you charge for your product?

Pricing is a critical aspect that often determines the success of products and services, businesses are often unsure about best practices for determining price. Going to market without a good understanding of how customers value your product can diminish how well your product sells and how consumers see your brand. However, implementing a pricing strategy can often be difficult. Without data on the price and performance of similar products, trying to set a price for your new product can feel like a shot in the dark. But it doesn’t have to be.

In this article, I introduce and analyze Van Westendorp’s Price Sensitivity Model, a data-driven pricing model that uses survey data to determine customers’ willingness to pay for your product. This article details how the Van Westendorp model works, why it addresses shortcomings in current pricing conventions that many businesses use, and what its limitations are. In addition to secondary research, I interviewed Brian Balfour, Founder and CEO of Reforge, and Dr. Z. John Zhang, Professor of Marketing at Wharton, to incorporate their thoughts on product pricing strategies and the Van Westendorp model into this article.

What Businesses Get Wrong About Pricing

Tens, if not hundreds, of different pricing strategies are used by small- and medium-sized businesses, but many prove ineffective. “One of the key reasons why small businesses fail is because they just aren’t pricing right,” Dr. Zhang explained. “Either you price too low and you don’t have enough money, or you price too high and nobody is buying your product.” In particular, businesses launching a unique product into an untested market often struggle to identify an optimal price point. While products with competitors have multiple reference points for price, there is not much existing market data that can help you determine the ideal price for a product with no comparables.

In this case, companies may choose to implement a survey of potential buyers to gauge their willingness to pay for the product. The most popular method is to just ask the potential buyer outright what they would pay for the product. This “direct question” method, which seems simple and easily interpretable, has a number of flaws. First, most consumers have a range of acceptable prices that they would be willing to pay for a certain product, not just a single price point. In addition, studies have shown that asking outright for willingness to pay tends to result in “lowballing”, where potential buyers purposefully answer with a lower price than their real willingness to pay. These buyers may try to motivate the company to lower their price for the product, so that they can purchase it for less. Furthermore, some people may genuinely be unsure about how much they would pay for the product. Brian Balfour highlighted that many individuals “have a really difficult time answering questions like ‘how much would you pay for this?’ since a lot of purchasing decisions come down to emotions.”

The Van Westendorp Model: Determining Optimal Price Point

Van Westendorp’s Price Sensitivity Model provides a more comprehensive, multi-question model that indirectly measures willingness to pay instead of directly posing the question to potential buyers. Rather than asking potential buyers to identify a single price point, the Van Westendorp model helps assess a range of prices instead of just one. The following few steps detail how this pricing strategy works.

First, the following four questions must be posed at the end of the survey:

- At what price would it be so low that you start to question this product’s quality?

- At what price do you think this product is starting to be a bargain?

- At what price does this product begin to seem expensive?

- At what price is this product too expensive?

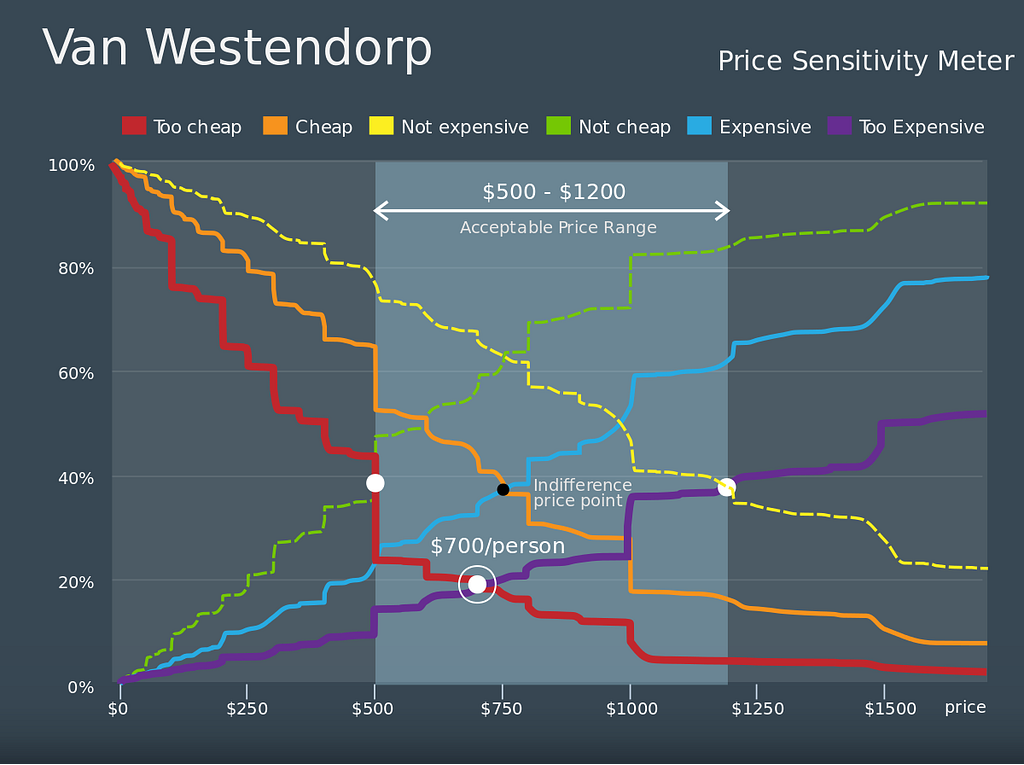

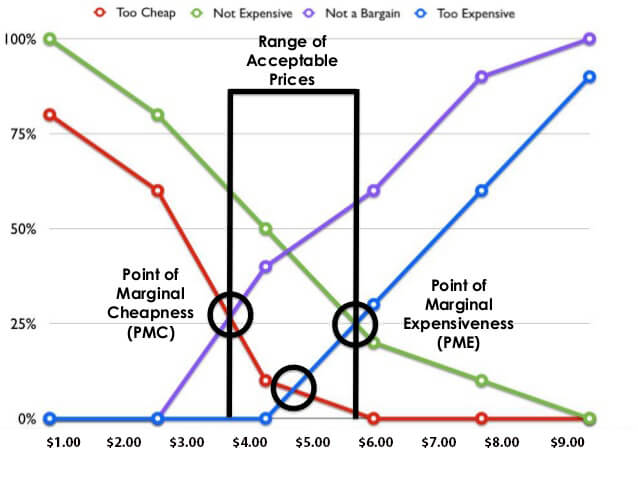

After results from this survey are collected, they should be visualized on a line graph with price on the x-axis and the number of respondents on the y-axis. On this graph, you directly plot the cumulative number of people who believe that the product is too cheap and too expensive on the graph. You also plot the number of people who thought that the product is not yet expensive or not yet a bargain on the graph. The figure below shows an example Van Westendorp graph.

As price increases, the number of people who believe that the product is too cheap or not expensive decreases, while the number of people who believe that the product is not a bargain or too expensive increases. This results in a few intersection points that provide valuable insights for the ideal price ranges.

The intersection of the number of people who think that the product is “too cheap” and “not a bargain” is the Point of Marginal Cheapness. If the price of the product is set any lower than this point, more buyers would say that the product is too cheap, and so this point acts as a lower bound of acceptable prices. Similarly, the intersection of the “too expensive” and “not expensive” lines is the Point of Marginal Expensiveness, which acts as an upper bound of potential prices. These two boundaries together provide a range of prices that a company can test for its products.

Additionally, the intersection of the “too cheap” and “too expensive” lines is called the Optimum Price Point (OPP). This price is located between the Point of Marginal Cheapness and Point of Marginal Expensiveness, and in theory, this price is the optimal price because it minimizes the number of people who are dissatisfied with the price of your product one way or the other.

The Van Westendorp model is very effective in gauging consumer sentiments surrounding a potential range of prices. Mr. Balfour stated how “bias is reduced because it’s not a single question about a single point, but a number of questions that help you triangulate somebody’s true willingness to pay.” The pricing model functions best with a large sample of survey respondents, which creates a real continuum of how willing to pay customers are at specific prices.

Limitations and Improvements

There are a number of limitations to keep in mind while using the Van Westendorp model to help determine a product pricing strategy. First, the entire methodology assumes that the surveyed individuals have some sense of what the product or service is worth. B2B products tend to work best for this method, since corporate consumers have a strong understanding of their priorities and needs. For consumer products launching into new markets, this can prove to be challenging. Companies in this position should try to provide as much product information as possible to the consumer throughout the survey, to obtain more reliable responses for price.

The Optimal Price Point calculated by the Van Westendorp model also only gauges consumer sentiment without considering fixed and variable costs. Dr. Zhang argues that “Certainly the OPP [in the Van Westendorp model] is not the actual optimal price; when determining the optimal price, you have to consider your costs too to see how you can increase profits. An optimal price without any information on your costs is very flawed to start with.”

Another limitation is that the Van Westendorp model does not take into account potential responses from competitors. There is no intuitive way to factor competition into the Van Westendorp model; therefore, it should primarily be used for pricing new products entering the market, not existing products with many competitors.

Ultimately, any Van Westendorp analysis should be supplemented with validation testing and profitability data from real sales in the market. As Mr. Balfour emphasizes, “the best way to determine pricing is through live testing because live testing incorporates all the possible elements surrounding someone’s decision to convert into a customer. This includes the emotional aspects, the context, and the intents, which are impossible to capture in a survey.” While many companies do not initially have the resources or sales volume to conduct reliable live tests, this actual market data should always take precedence over survey analysis and should be used to test assumptions made using the Van Westendorp model.

Taking Insight from Customers

While the Van Westendorp model may not present a single optimal price on its own, it does help businesses understand how consumers value their product and determine a range of acceptable prices to consumers. Small- and medium-sized enterprises launching new products or services should particularly consider the Van Westendorp model for the market insights it can bring and its relative simplicity. When implemented correctly, this model can produce successful pricing strategies for a wide range of consumer- and business-oriented products. By using Van Westendorp analysis alongside other techniques, including validation testing and debiasing algorithms, any company can develop unique methods that inform its product’s ideal monetization and pricing model.

Acknowledgements

Thank you to Brian Balfour and Dr. Z. John Zhang for taking the time for our interviews and for contributing valuable insights to this article.

How To Price Your Product: A Guide To The Van Westendorp Pricing Model was originally published in Strategica Partners on Medium, where people are continuing the conversation by highlighting and responding to this story.