When entering the market with a new product, it is vital to have a focused action plan. Each product is unique, and without clear methods for targeting and acquiring customers, you may be left unsure about what you are seeing or why you are seeing it. You must have an understanding of the motivations and actions of early users because the real value comes from learning to scale their feedback for growth. If you haphazardly throw a product onto the market, you may start optimizing for a less profitable market segment because you are looking at sheer volume of the market versus the total value it captures. To help avoid these pitfalls, you must develop a go to market strategy. This course of action will help you define your target customers, brand positioning, and marketing strategy.

There are several steps that constitute an effective go to market strategy. It is necessary to thoroughly consider each step to capture full insights into early customer acquisition and sales.

- Segment Target Markets

- Identify Target Customers

- Develop Actionable Personas

- Determine Brand Positioning

- Devise a Marketing Strategy

Process

I. Segment Target Markets

Market Segmentation

Many companies are quick to launch “experiments” to test marketing tactics through various channels, without the foundation of understanding how to position their products, target the campaigns, or interpret results.

Market segmentation is the foundation for all your positioning, marketing, branding, and product road-mapping. Before doing anything customer-facing, you must identify the right market segments for your product. A general rule of thumb is that any market can be broken up into sixteen different segments. For example, the beauty market could be broken down by geography (e.g. North America, Asia), type (e.g. hair, skincare), product (e.g. styling tool, makeup), and many other similar categories. If you only make a general statement about the market you are entering (e.g. the global beauty market is an $X billion industry), it is likely that you will make imprecise metric projections because it is improbable that you will be able to capture the entire market. Without accurate market segmentation, there is a lot of potential for missed revenue growth.

Market Sizing

Sizing your market is extremely important but also somewhat difficult. While it may be tempting to categorize the market you are entering by the total available market (TAM), you are most likely starting with zero percent market share, so you cannot credibly speculate what percent of the TAM you will capture in the future. Additionally, if you base your projections on the TAM, you will probably be sizing the market incorrectly because of shifting norms or a lack of adept segmentation. Consequently, bottom-up projections tend to be more valuable than top-down market share speculations when developing internal revenue projections and accurate representations for investors. A bottom-up projection says that you expect to have A customers at B dollar value, totalling C revenue in year D, whereas a top-down approach says something like you are going to capture X% of Y market in a certain timeframe. You should consider your pricing, your market size, and your customer’s willingness to pay when outlining these numbers. Investors tend to prefer the bottom-up method because it is easier to granularly tell if you are reaching your projections.

II. Identify Target Customers

Target Market Criteria

Once you segment the market, you want to identify which component of the market to target. Selecting a target market is a very important step, because if you are not very clear about whose feedback you are incorporating, it’s very difficult to have a high growth model. Ideally, you should select no more than three categories of customers to target. Selecting a target market should yield personas that reflect the priorities and values of real demographics. They should include enough detail to be actionable by every stakeholder in the organization.

Product managers, marketers, engineers, and sales reps should all understand the persona and apply them to their projects. You want to understand how people spend their days, the kinds of platforms they engage with, and where they turn to make decisions (e.g. asking a co-worker or searching online). This often feels overly detailed to stakeholders at the beginning but plays a foundational role when projects and campaigns are executed.

There are three factors that you need to consider when identifying target customers:

- Willingness to Pay by Cohort

First, you need to determine what your target is willing to pay for the product or feature. Whether you’re creating a category or entering a space with existing alternatives, a lack of direct competitors is not inherently an advantage.

It is entirely possible that there will be users that see the value in your product and enjoy using it but are deconditioned to paying for it. For example, a user of a ride-sharing app may value a feature that shows them real time traffic but users may expect that feature to be free because of apps like Google Maps, and thus unwilling to pay extra for it. It’s also very likely that users of premium features have higher willingness to pay and value features differently, so overlooking cohort analyses could obscure their data in the sheer volume of mid-tier customers with different preferences.

2. Market Trends

You do not want to enter a market that is shrinking, so it’s important to properly gauge market momentum. This is especially true for companies looking to raise venture capital. The old adage “It’s hard to be big in a small market” rings true for most institutional investors.

However, if there is a large enough market, and you have some proprietary development advantage, or a niche market you want to use to expand into others, it could be profitable to go into a contracting market. Despite this, if your situation does not match this criteria and you still choose to enter a shrinking market, it is more likely that you will be building products for a cohort that is less likely to return value over time.

3. Unique Value Proposition

Third, you want to make sure you have true category differentiation. Unique is the operative word here and should be assessed from the perspective of your customers.

Your product application and unique value proposition need to revolve around what your audience cares about. While you may think your product is completely differentiated because there are no other products on the market like yours, this could also mean there is no demand for it. On the flipside, if the market is extremely saturated, and the user base cannot distinguish your product from another, then there is not much value in differentiating your product by making it feature-specific. Unique branding around core company values, instead of feature differentiation, yields higher returns and more impact than focusing on the feature-level in saturated markets.

Furthermore, there will always be a multitude of ways to describe your company. Your job is to figure out which resonates most with the audience and drives conversions. It’s most effective if you use your target market’s words to do so. While you may think your company provides value in one way, your target market may care about three factors that you internally thought of as secondary. Words that the internal team believes to be synonymous with what you’re hearing from the market may not be seen that way from their perspective. “Accurate” and “reliable” may sound interchangeable to us, but they may not be from the market’s perspective.

You want to leverage their priorities by understanding the value of your product from their perspective and using their own words as the foundation of your positioning and market strategy.

III. Develop Actionable Personas

Buyer vs. User Persona

There is a common misconception in believing that the buyer and user are the same. The buyer and user often behave fundamentally differently because of their experience in existing association with your product. Buyers are people who do not currently have your product. They may not be the end user or they may not yet have the knowledge that a user would. For this reason, you want to segment out what your buyer and user personas look like. While both of these categories will be based on the same target customers, they may not have the same characteristics.

You want to understand what drives certain actions of each group, what stage do internal or external factors make them consider using your product, and how do their motivations overlap or conflict. It is entirely possible that the buyer’s priorities and preferences will be fundamentally at odds with the user’s desires. For example, in education technology, the end users are usually teachers and students, whereas the buyers are usually district tech administrators and principals. At the school level, teachers could have a vested interest in less expensive software that meets their needs better. In contrast, the district tech administrators may have the personal risk of rolling out and implementing new technology that would require retraining thousands of teachers. Additionally, the district could receive negative feedback if the integration does not go well. In this case, it may not be worth it to the buyer to purchase your product. This misalignment in values is why it’s important to understand the preferences and priorities of the buyers and users of your product.

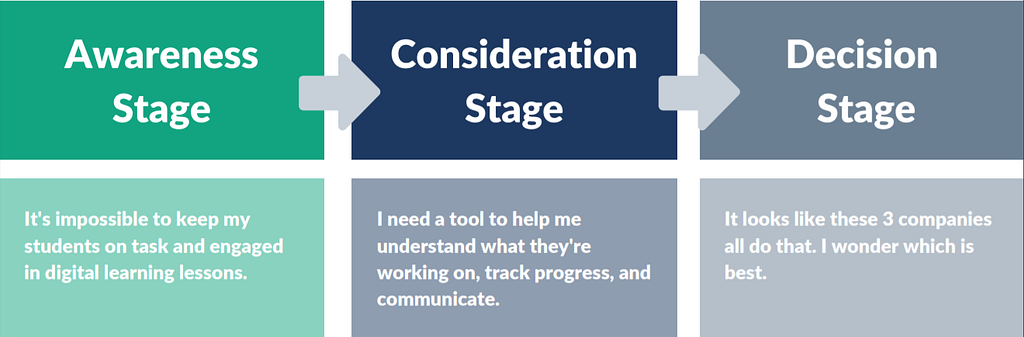

Mapping Buyer’s Journey

Mapping your buyer’s journey can help you understand their process when examining and considering your product. The three broad phases of mapping your buyer’s journey are awareness, consideration, and decision. Buyers first become aware of a problem they have, then they consider possible solutions to their problem, and lastly, they decide what action to take to fix the problem. Many times, companies jump directly to the decision phase and assume buyers already see the value in their product. This is true for a lot of feature-focused positioning where companies assume buyers are just picking between different products, when in reality, they have yet to be guided to the market for that product. Mapping these scenarios gives you a strong foundation for your distribution, marketing, and branding strategies. Additionally, it allows you to quickly identify potential sources of feedback and points of emphasis along the buyer’s path to your product.

IV. Determine Brand Positioning

Mission, Vision, and Offerings

After the target market is identified, you want to use their own words as the foundation for your positioning strategy. Developing a position that motivates and drives consumers to purchase your product can be challenging. To make an impactful statement, you must position in a way that speaks to the customers priorities. One common mistake when trying to do this is being overly aspirational. A product may claim to be something so abstract and fluffy to the point where no one really understands how it works. For example, an education company might claim to “unlock a student’s full potential” or “make learning better.” These claims are too generic and speculative. You want to make your product visceral and focused on the priorities your customers care about, while tying into a higher brand promise that can still be aspirational. On this note, the homepage on your website should capture your mission, vision, and offerings. It needs to have something explicit and tactical so that potential customers can quickly understand if your product is relevant to them. Make it very obvious what your product does and what it looks like while still painting who you are, what you care about, and your core values. While there are many factors to consider, in the end, your product’s positioning ultimately depends on the values and perspectives of your target consumers.

VII. Devise a Marketing Strategy

Where to Start

Rather than taking a grand stance, consider more organic options to begin marketing. You do not need to spend money on elaborate social platforms or ad boards. To get an idea of what is working well, you can use blogs, emails, or one-on-one testing with your audience before you have to spend a penny on paid advertising. These organic options give you a better idea of the type of paid advertising that may be effective when you start investing in the necessary platforms. Ask yourself the question, “If you have zero marketing dollars, what would you do?” This can lead to some of the most effective and innovative experiments and tests that will generate useful insights.

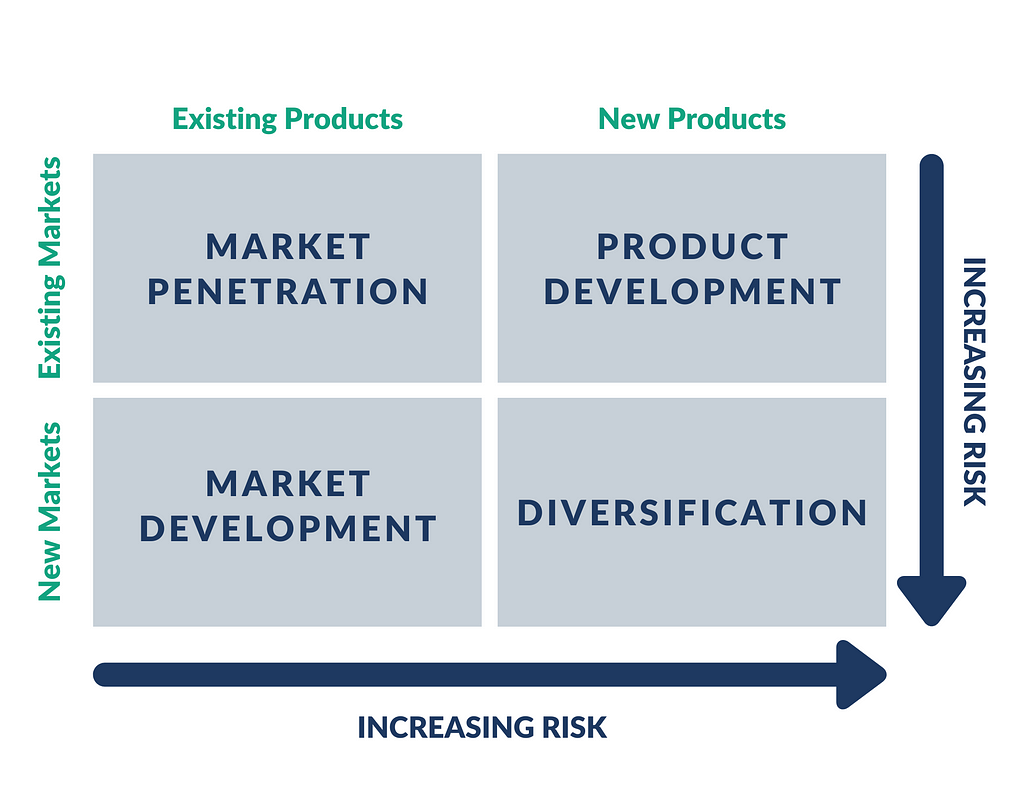

Competitor, Market, or Product Approach

There are three main approaches to consider when it comes to marketing: your competition, your product, and the market. You should be wary of focusing too much on competition. If you base your decisions off of your competitors’ choices, you run the risk of using criteria that may not hold for the questions you are trying to answer and may be ineffective. Being mindful of the alternatives your customers have is important, but replicating competitors can lead you astray with very little differentiation. In the same vein, being too product focused can often lead to blind spots in the early stages. If you are too married to the idea of the product as you envisioned it, you may selectively listen to the feedback that could make it better because you have not taken a true market focus. Focusing on the market and how your product can fill a need is typically the most effective marketing approach. Through this avenue, you have really figured out the priorities of the audience and what they need solved. Your product is the manifestation of how you serve your customers needs.

Key Market Research Questions to Ask

It is common for companies to do product research and think they are doing market research. For example, if you were to ask someone what their average day looks like, what they care about, or what their last topic of conversation with their boss was, you are going to get a sense of their priorities in terms that may have nothing to do with your product. This is market-focused research, which is useful when trying to understand what potential customers care about and if there are opportunities to tie their priorities to your product. Examples of product-focused research would be asking someone how likely they would be to try your product, why they bought your product, or what they thought of the user interface. While market research and product research are both important, they should not be interchanged. If you introduce your company and product before conducting your research, you are already setting yourself up to get biased results. In surveys and interviews, revealing minimal information about your company and your product will grant you more authentic and valuable results. You do not want to base your research off of your current perceptions of the market because they could be drastically different from the real picture. Through research, you want to understand what is most important to your target customers, as it is possible that the positioning points that you internally developed may not speak to the primary values of your target audience. However, you will never know this until you ask. It can be very beneficial to dive deep into these five questions below:

- What are the user’s priorities?

- Are they different from the buyer’s priorities?

- How do you compare in the market?

- How is the market changing?

- Which is most important?

Evaluating Marketing Performance

If you are looking to build a house, you must have a blueprint before you start doing construction. In the same vein, you must have a marketing plan before you begin to market your product. However, you need to evaluate your marketing performance in the exact opposite way; you must look tactically before you look strategically. Drawing on the house-building analogy, if you had a plumbing mishap, you would never say indoor plumbing is not a viable option to include in the house. Instead, you would look at why the pipe broke, how it was installed, and what it was connected to. Despite this, it is very common for people to make illogical assumptions about their marketing strategy. For example, they may irrationally say email marketing does not work for their company or that their audience is not on social media. This could be true, but usually it is based on a singular dashboard or campaign that has not taken into account how things have been fine-tuned, developed, and executed. These narrow and declarative statements could lead to overlooking opportunities and are often the result of undeveloped positioning frameworks or market segmentation.

CONCLUSION

In order to carry out the suggested go to market strategy steps, there must be action involved. Although this can seem overwhelming at first, you shouldn’t assume that you should have all of the answers right away. In fact, it’s more important to identify the right questions to ask your target market because these answers will be better than the assumptions you may make. Taking time to thoroughly segment target markets, identify target customers, develop actionable personas, determine brand positioning, and ultimately devise a marketing strategy will give your product the most chance for success.

Developing a Go To Market Strategy was originally published in Strategica Partners on Medium, where people are continuing the conversation by highlighting and responding to this story.